Find out the information you need about Current Mortgage Rates St Petersburg Fl in this article, all summarized clearly by us.

Exploring the Latest Mortgage Rates in St. Petersburg, FL

Greetings, readers! As a homeowner and mortgage enthusiast, I’m thrilled to delve into the dynamic world of mortgage rates in our vibrant city of St. Petersburg. Embark with me on this insightful journey as we uncover the latest trends, expert advice, and everything you need to know about securing your dream home in the Sunshine City.

The Pulse of the St. Petersburg Mortgage Market

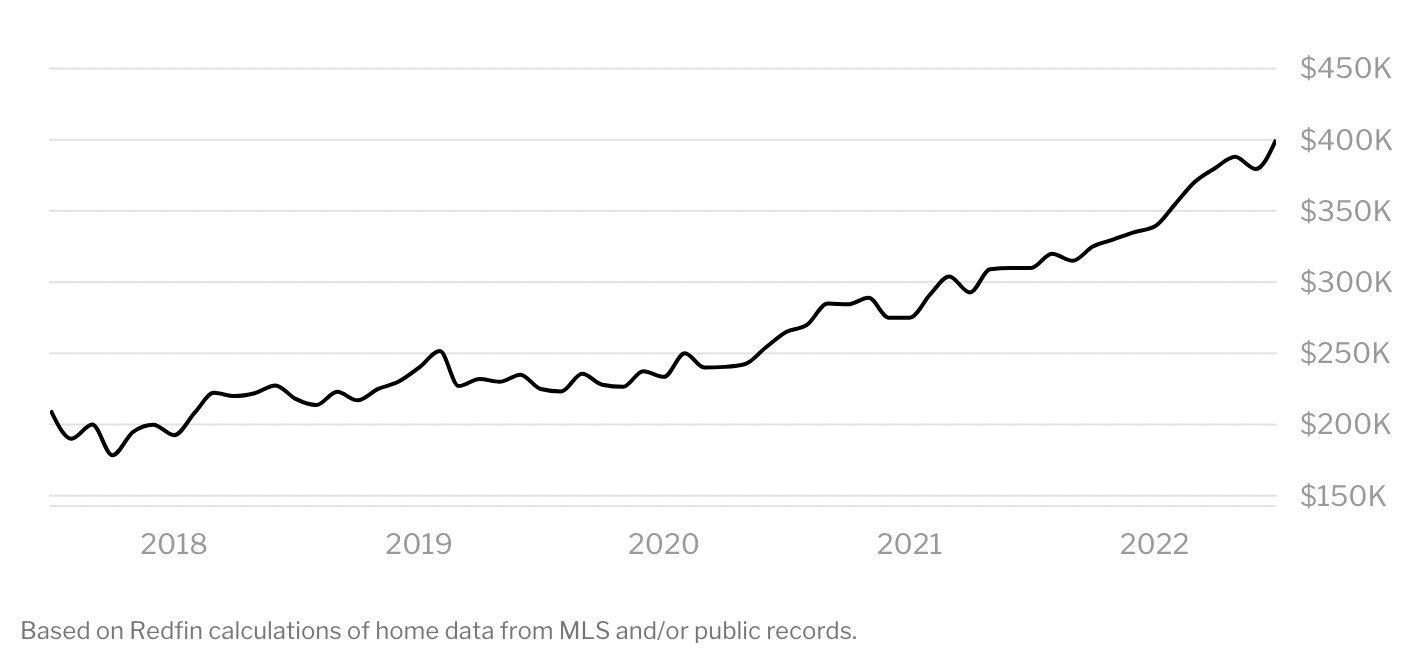

The St. Petersburg mortgage market is experiencing a captivating fusion of opportunities and challenges. While interest rates remain historically low, home prices continue their upward trajectory. Understanding these market dynamics is crucial for making informed decisions about your mortgage financing.

Inside the Nuances of Mortgage Rates

Mortgage rates, simply put, determine the interest you pay on your borrowed loan amount. They fluctuate based on economic conditions, government policies, and market demand. In recent years, we’ve witnessed a rollercoaster ride of rate changes, but the overall trend has been towards lower rates. This has significantly impacted affordability for homebuyers, making it more feasible to own a property in St. Petersburg. However, as the economy recovers and interest rates rise, it’s essential to stay up-to-date on the latest market conditions to secure the most favorable rates for your mortgage.

Decoding the Mortgage Rate Landscape

The vast world of mortgage rates can often feel like a labyrinth, but with a clear understanding of the key factors involved, you can navigate it with confidence. Let’s demystify some of the most important elements:

- Loan Amount: The sum of money you borrow directly influences the interest rates you qualify for.

- Loan Term: The length of your mortgage, typically 15 or 30 years, also impacts interest rates.

- Credit Score: A strong credit score signals to lenders that you’re a reliable borrower, reducing your perceived risk and qualifying you for lower interest rates.

- Down Payment: Making a larger down payment reduces your loan amount, which can also lead to lower interest rates.

- Type of Mortgage: Different mortgage types, such as fixed-rate and adjustable-rate mortgages (ARMs), come with varying interest rate structures.

Capitalizing on Expert Insights

Navigating the mortgage landscape can be overwhelming, but seeking counsel from seasoned professionals can provide invaluable guidance. Here are a few expert tips to help you make an informed decision:

- Shop Around: Compare rates from multiple lenders to find the best deal. Don’t settle for the first offer you receive.

- Lock In Your Rate: Once you’ve found a favorable interest rate, consider locking it in to protect yourself from future rate increases.

- Consider Refinancing: If interest rates drop significantly after you’ve secured a mortgage, refinancing can save you money on your monthly payments and over the life of your loan.

- Explore Government Programs: There are various government-backed mortgage programs available to first-time homebuyers and low- to moderate-income families, such as FHA loans and VA loans, which can offer competitive rates and flexible financing options.

Frequently Asked Questions

Q: What’s the difference between a fixed-rate mortgage and an adjustable-rate mortgage (ARM)?

A: Fixed-rate mortgages offer stable interest rates throughout the loan term, while ARMs have interest rates that fluctuate based on market conditions.

Q: How can I improve my credit score to qualify for lower interest rates?

A: Make timely payments on all debts, keep your credit utilization low, and avoid opening too many new credit accounts in a short period.

Q: What’s a good down payment percentage?

A: While 20% is often considered a benchmark, making a larger down payment can reduce your interest rates and monthly payments.

Conclusion

The pursuit of your dream home in St. Petersburg, FL is an exciting adventure. Through the insights shared in this article, you’re now equipped with the knowledge to navigate the mortgage market and make informed decisions that will shape your financial future. Whether you’re a first-time homebuyer or a seasoned homeowner, I encourage you to continue exploring the latest mortgage trends and expert advice to optimize your financing strategy.

Do you find the topic of mortgage rates in St. Petersburg, FL intriguing? If so, share your thoughts, questions, or personal experiences in the comments below. Together, let’s continue the conversation and empower ourselves in the ever-evolving world of homeownership!

Image: houwzer.com

An article about Current Mortgage Rates St Petersburg Fl has been read by you. Thank you for visiting our website. We hope you benefit from Current Mortgage Rates St Petersburg Fl.

Hovk.org Trusted Information and Education News Media

Hovk.org Trusted Information and Education News Media